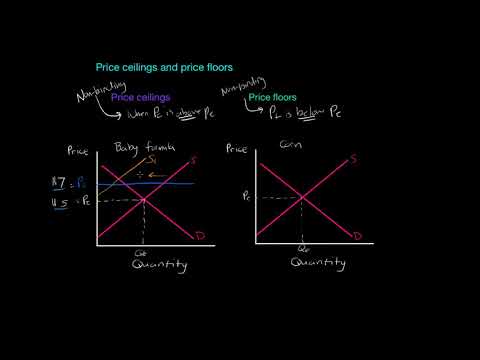

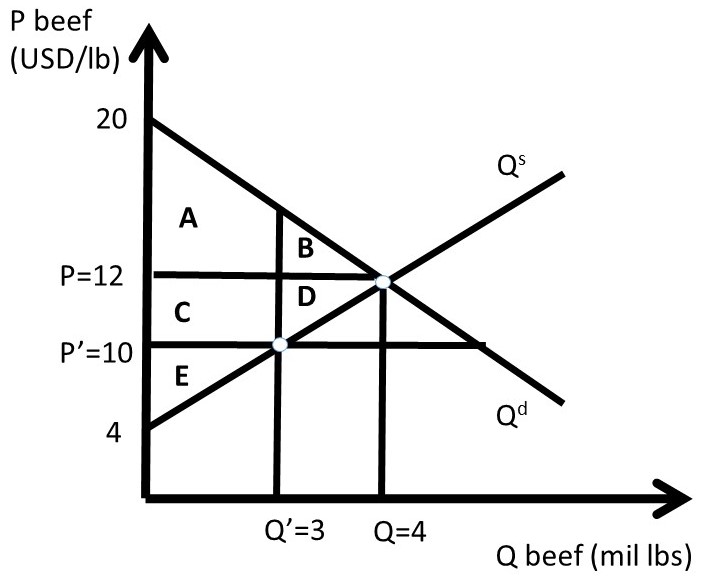

Price Ceiling Above Equilibrium Deadweight Loss

Equilibrium price 5.

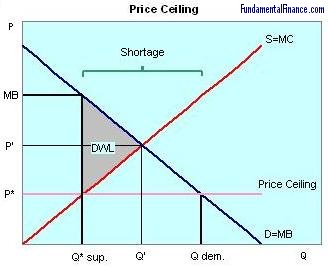

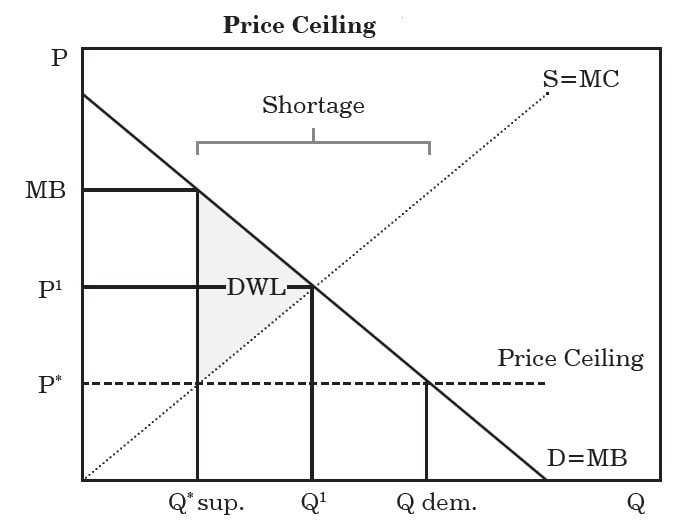

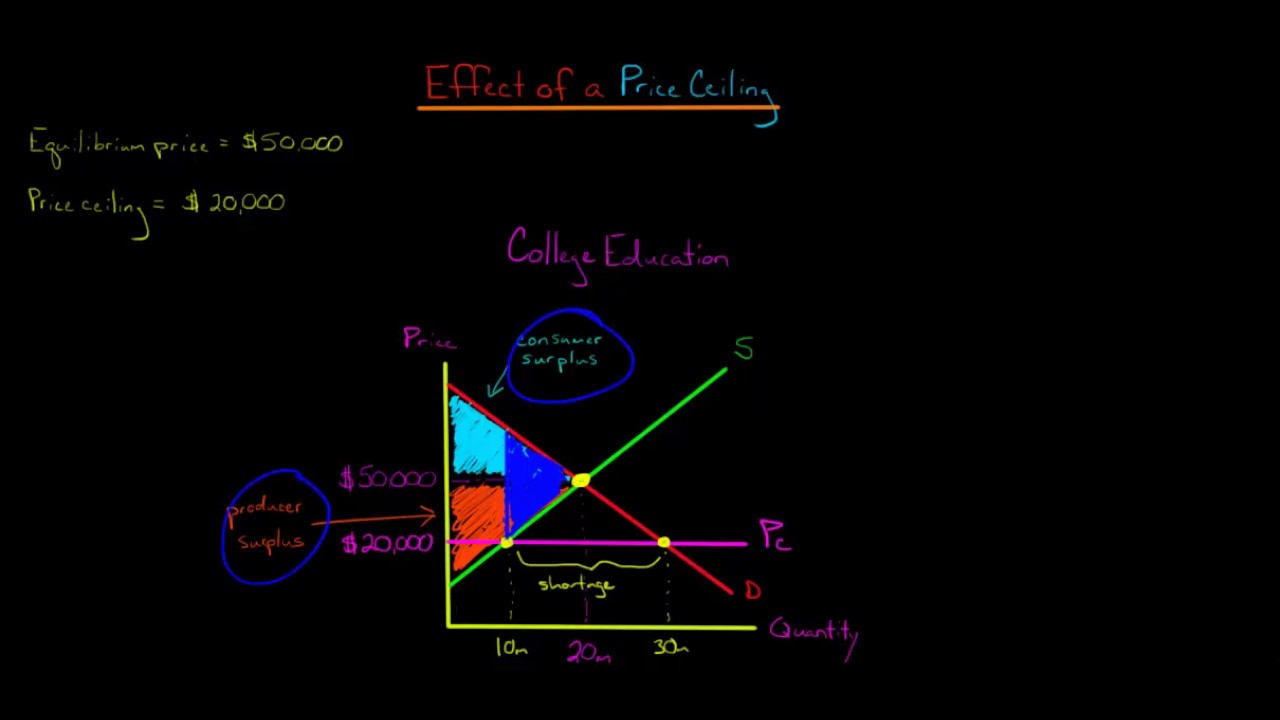

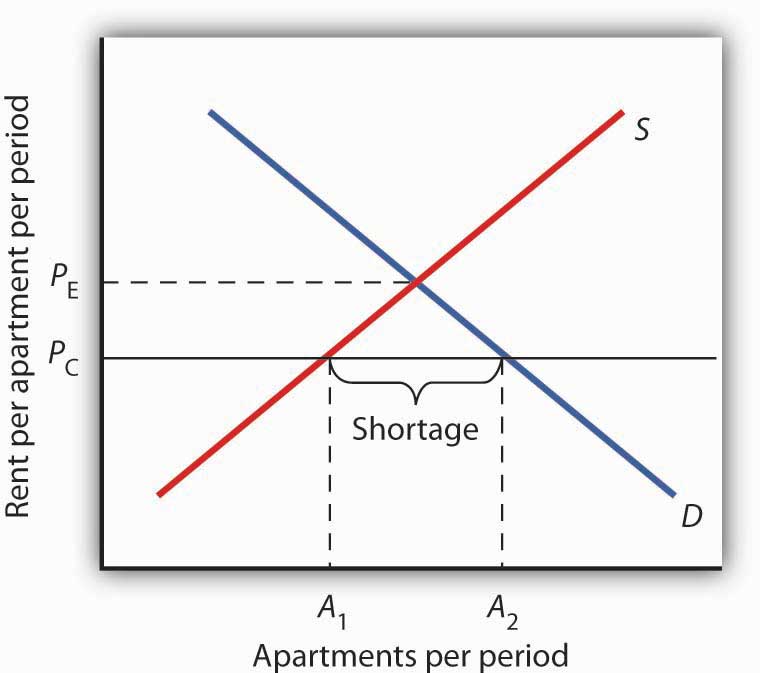

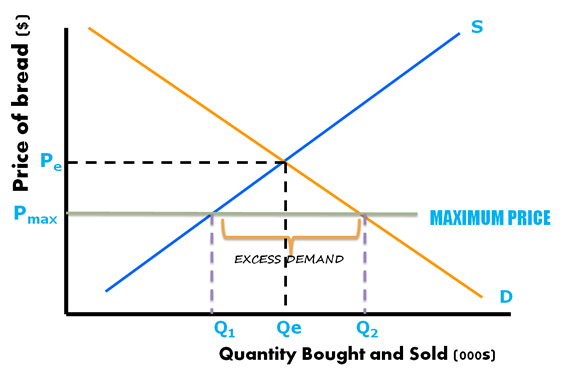

Price ceiling above equilibrium deadweight loss. In equilibrium the price of rent is 1 000 with a quantity of 100. At equilibrium the price would be 5 with a quantity demand of 500. Practical example of a price ceiling. Deadweight loss occurs when supply and demand are not in equilibrium which leads to market inefficiency.

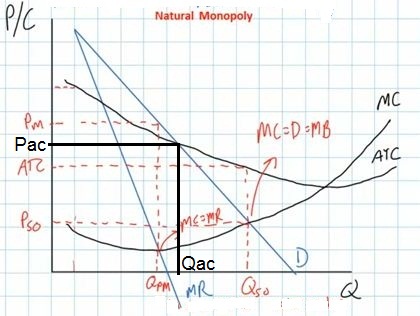

The price demand at the quantity of 90 is 1 100. An inefficiency occurs since at the price ceiling quantity supplied the marginal benefit exceeds the marginal cost. This inefficiency is equal to the deadweight welfare loss. This graph shows a price ceiling.

How does quantity demanded react to artificial constraints on price. In addition regarding consumer and producer surplus. Tax incidence and deadweight loss. Determine the deadweight loss created by the price ceiling and the quantity shortage.

At the ceiling price of 900 quantity demanded is 110 while quantity supplied is 90. Economics and finance microeconomics consumer and producer surplus market interventions and international trade market interventions and deadweight loss. When prices are controlled the mutually profitable gains from free trade cannot be fully realized. Consumer surplus is the consumer s gain from an exchange.

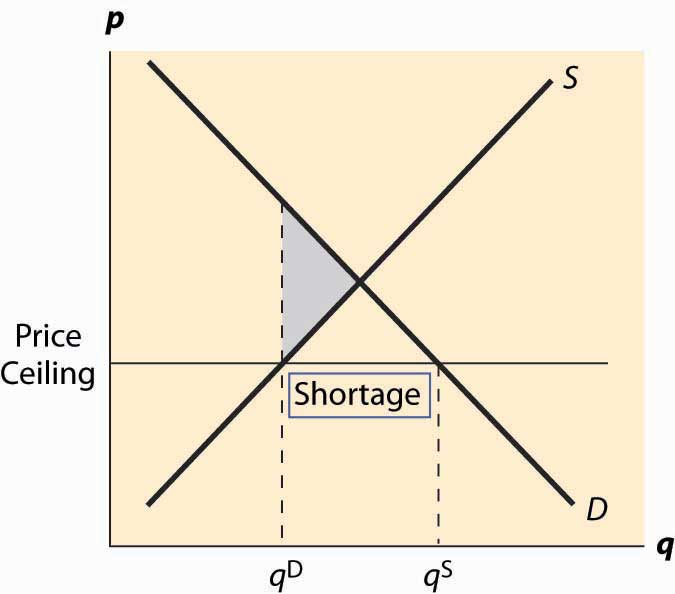

There is also less supply than there is at the equilibrium price thus there is more quantity demanded than quantity supplied. In this video we explore the fourth unintended consequence of price ceilings. Equilibrium demand 500. Due to the extremely high demand for rental housing the government decided to regulate the situation by imposing a price ceiling of 900.

Market inefficiency occurs when goods within the market are either overvalued or undervalued. The consumer surplus is the area below the demand curve but above the equilibrium price and up to the quantity demand.